Cash flow statement in vernacular

The cashier is known to be king in both personal and corporate finances. However, the cash flow statement is often considered difficult to understand. This is logical, as it is not customary on the personal side to draw up the profit and loss account and the balance sheet that make up the numerous lines in the cash flow statement. In personal life, there is also no need to weigh up which part of the assets in the account are VAT liabilities due to the tax authorities or whether VAT claims are expected from the tax authorities. However, by unpacking the cash flow statement into smaller parts and mirroring it in the personal monthly cash flow statement, it becomes an easy-to-understand whole.

Theoperating flow statement consists of cash flow from operating activities, cash flow from investments and cash flow from financing activities. In simple terms, the cash flow from operating life can be imagined as the everyday cash flow of income and expenses.

The cash flow from investments can be imagined as the cash flow of larger personal investments that differ from everyday life, such as buying or selling a home or car.

On the personal side, the cash flow from financing can be imagined as a cash flow that is not related to everyday income and expenses. For example, it would consist of an increasing amount of money with a mortgage and a decrease in the amount of money that will decrease as a result of its repayments.

Note. The following examples are described according to the most commonly used accrual-based posting method.

Cash flow from operating activities (A)

As I presented above, the cash flow from operating activities can be seen as the everyday cash flow of income and expenses in everyday life. Tax is paid on the wages, which reduces the amount of wages left in the hand. With the remaining share, we pay everyday expenses consisting of groceries, children's hobby fees, electricity and water bills, insurance and rent for rented dwellings, etc. It is good to note that while the rent of a dwelling would be included in the cash flow of everyday life (business), the loan repayment paid for owner-occupied dwellings would be counted in the cash flow from financing.

It is clear that if we do not get paid on time, it will reduce our everyday cash flow that month. If, in turn, we do not pay our bills on time, it will naturally increase the cash flow for that month. In everyday life, getting a salary into an account means that the income has been paid and the invoices are paid into expenses. Unlike the company's accounts , personal cash flows are not expressed in the income statement and balance sheet, which could also be interpreted by a third party.

Cash flow from investments (B)

As I mentioned above, the cash flow from investments can be imagined as a cash flow of larger non-everyday personal investments, such as buying or selling a home. Clearly, the purchase of a dwelling reduces and the sale in turn increases cash flow for the month of the transaction.

Cash flow from financing activities (C)

A previous example of increasing foreign capital in everyday life with a mortgage illustrates the cash flow from finance. There is also a debt flow of equity in the business world, which may arise, among other things, when the owners of the company recapitalate the company with their personal funds or through a paid share issue to investors, group grants received and granted, and dividend distribution.

According to a simplified example, a positive cash flow from financing for a given month means that a company has borrowed more or that more equity investments have been made in the company than the company has repaid its loans or uninvested its equity investments. Loan withdrawals, paid increases in equity and group grants are so rare that companies with loans most often have negative financial cash flow.

A+B+C = Change in cash and cash reserves for the period

Dr Toivo Koski, PhD, sums up the importance of the cash flow statement well in an article he wrote ,"the directors or financial persons of successful companies have practically established that invoices and salaries cannot be paid with profits shown in the financial statements, but only with fully liquid cash resources." By budgeting for the future development of the result and balance sheet, the company can also assess, among other things, whether the existing cash reserves and cash flow from operating activities are sufficient to repay loans for future investments.

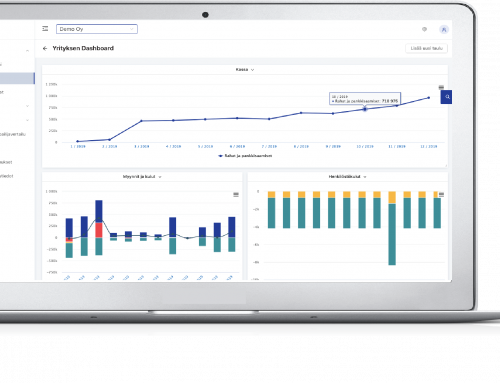

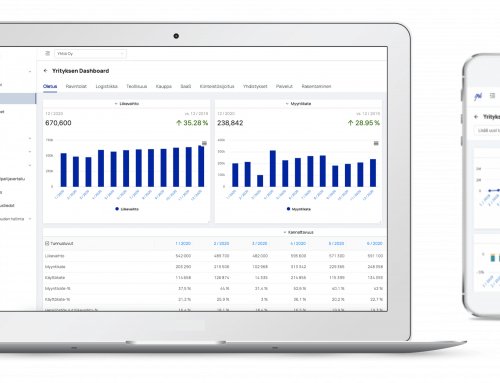

Finadeck's intelligent financial management and reporting software is designed to make it easier for companies in budgeting, investment planning, analysis of key figures and cash flow, and – visual reporting, industry and competitor comparison, valuation and financial search.