Four practical tips for applying for funding

Funding and applying for funding for investments are a favourite subject for few entrepreneurs, although information is now available more closely. In many cases, the most competent help would be found in your accounting firm, where more and more people offer financial manager and controller services as an additional service for traditional accounting services. However, few SMEs take advantage of this opportunity. However, careful planning of investments and financing would be of great benefit to both the company and the financier.

Here are 4 tips for accounting firms providing finance manager and controller services to support micro and SMEs in financial search and financial management

1. Result — and balance sheet budget preparation support

Mone's micro and SME budget goes with it at the entrepreneur's own end – undocumented. Without a structured budget, it is difficult for outsiders to understand the development of the company's financial situation and the impact of different scenarios on the company's cash flows. Fact-based, forward-looking decision-making becomes difficult.

For accounting firms providing financial manager and controller services, the first tip is to prepare a simple budget for the profit and loss account according to the chart of accounts, either at the main account level or at the sub-account level. In the income and balance sheet budget, it is advisable to take into account operating income and expenses, balance sheet depreciation plans, working capital development, potential sustaining investments and repayments and interest on existing and potential new liabilities.

The budget and the cash flow statement that is prepared from it allow the company to make the best possible decisions. They also allow accounting firms and financiers to support the company in decision-making. This is particularly important when assessing whether the company's cash flow is sufficient to repay the financing. With the right decisions, it is also possible for the company to increase its profits, optimise taxation and reduce economic risks.

Matters to be taken into account in the profit and loss and balance sheet budget:

- operating income and expenses

- balance sheet item depreciation plans

- development of working capital

- maintain the investment

- loan periods, payment programmes and interest on existing and potential new exposures

2. Financial structure scenario analysis

When considering the financing of an individual investment, it is important to weigh up which financial instruments and financial structure the investment will be carried out with. Alternative financial instrument and financial structure calculations help to understand what kind of financial structure is best suited to the company in terms of the price of financing. At the same time, it can be determined how much the company is prepared to commit its own collateral to the desired financing solution. The reflection also clarifies the picture of the target equity ratio and cash position.

Next, it is worth considering whether all or part of the financing of the investment could be done, for example, with another instrument instead of a traditional bank loan and a statement of accounts. Alternatives may include, for example, target-backed co-payment financing, leasing, receivable finance, the sale of invoice receivables or a loan binding on higher-interest loans. In addition to calculating the price of financial instruments and the required collateral, it is useful to calculate how external guarantees – such as finnvera's guarantee – affect the final price of the financing solution. In addition to the price, it is also necessary to examine the impact on the guarantees and guarantees for the company and the entrepreneur.

3. Support for the making and maintenance of a business plan

The preparation of the budget is based on a view of the future situation of the company, which is good to be written into the business plan, at least when applying for funding. Without a business plan, budgeted figures and their cause and effect relationships are difficult to understand, which makes business management more difficult. In order to facilitate this, it is worth keeping the business plan short and very budget-illustrative, so that it acts as a manual for a budget-reading entity.

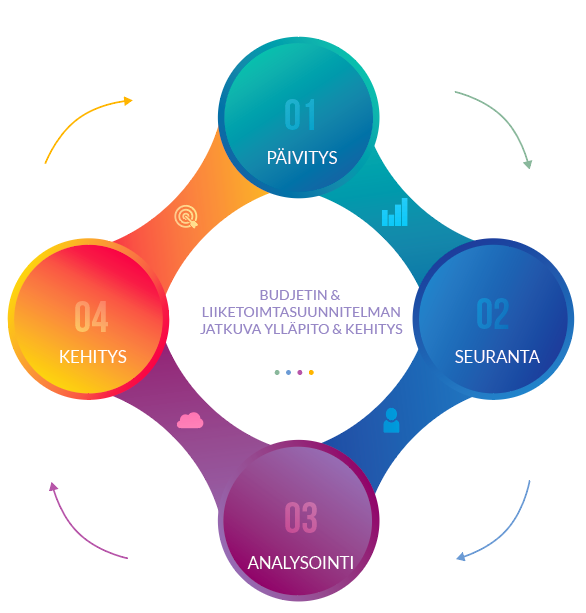

By providing support for updating the business plan on a cycle that suits the company, directs the accounting firm entrepreneur like a silk glove to pause for a moment and update the essentials. By updating the business plan, the accounting firm can help companies, among other things, plan, implement and monitor the strategy and detect changes in the surrounding market situation.

4. Profit and loss – balance sheet support for budget and margin update

When updating your business plan, you should also update your budget to reflect your vision of the future. The essential questions are whether the accuracy of budgeting meets the need to monitor and plan the company's operational and strategic finances, whether the budgeting time period is too short or too long, and whether the budgeting method is best suited for the fiscal year, the rolling budgeting method, or both.

In a cycle that suits the needs of the company, updating the business plan and budget significantly improves the company's and accounting firm's understanding of the cause and effect relationships between the company's business and financial condition. At the same time, the accounting firm's relationship with the company is deepening to a new level. The new understanding produces better financial management, benefiting the company, accounting firm and financiers.

In connection with the budget update, it is also useful to review the company's liability and collateral position and to record the schedule at least on the key future changes or opportunities for changes in the exposure and collateral position. For example, the entrepreneur has been able to take out Finnvera's guarantee as a filling guarantee, which may be unnecessary due to the changed situation. The review of the liability and collateral position can therefore be used to find ways to reduce, among other things, the total price of financing solutions, collateral requirements and the level of risk.

Supporting a company on a one-off basis in the search for funding

Financial manager and controller services as continuous support for the company's business development and financial search

Finadeck's smart, drill-down and customizable Accounting Firm Dashboard is designed to make accounting firms easier to monitor the financial situation of customer companies and financial consulting.

Finadeck's intelligent FINANCIAL Management and Reporting software for companies is designed to facilitate companies in budgeting, investment planning, analysis of key figures and cash flow, and – visual reporting, industry and competitor comparison, valuation and financial application.