Vauraus Suomi Oyj - Finland's leading corporate loan crowdfunding service

Vauraus Suomi Oyj, founded in 2011, is Finland's leading corporate lending crowdfunding service, connecting companies in need of flexible financing with investors looking for good returns. Vauraus provides corporate loans from €100,000 to promote entrepreneurial business and local economic growth. The Vauraaus Group includes several companies.

Vauraus Group employs about 40 people in Finland and its turnover in 2022 was about EUR 4.1 million. Vauraus is a crowdfunding service provider and a payment institution licensed by the Financial Supervisory Authority.

The need for group consolidation arose with the creation of subsidiaries

From 2020 to 2022, as the number of Vauraude Group's operating companies increased to several separate companies, Vauraude needed group accounting. With the need for group accounting, Vauraus started to look for a program that would conveniently handle the elimination of intra-group transfers, group budgeting, forecasting and reporting.

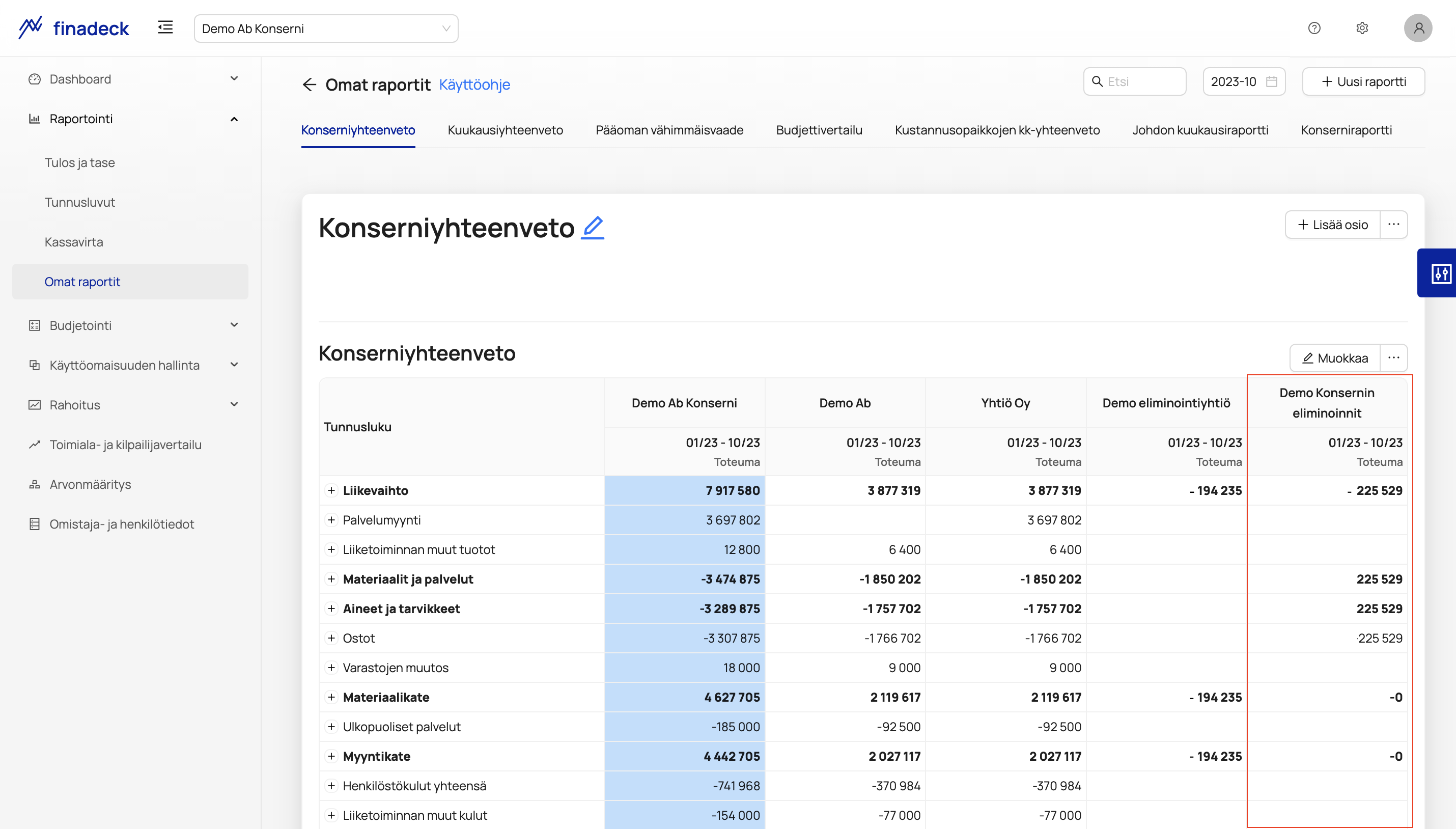

Screenshot of Finadeck's consolidated financial statements report

Before the creation of the group structure, Vauraus prepared the budget, forecasts and monthly and regulatory reports mainly in Excel, using about one day a month to prepare management and regulatory reports. In addition to saving time, Vauraus was looking for a solution to minimise the possibility of manual calculation errors.

"It was nice to see that Finadeck listened to our needs and was willing to prove the benefits of the software for consolidation already during the test period"

Vauraude was not familiar with Finadeck, but after Accountor recommended Finadeck to Vauraude, Marjaana Ervasti, Director of Administration, and Ritva Karling, Portfolio Manager, decided to get acquainted with Finadeck.

"It was nice to see that Finadeck listened to our needs and was willing to prove the benefits of the software in terms of consolidation by building us a group environment in Finadeck and the key figures and reports we defined for management reporting already during the test period," Ervasti says. With Finadeck automatically compiling reports from the data read in and automatically sending the desired reports to the desired people at the specified time, it was clear that Finadeck would bring Vauraude significant time savings.

In the photo, from left to right, Saku Pöllänen, CEO of Finadeck and Marjaana Ervasti, Chief Administrative Officer of Vauraus Suomi Oyj.

Activating the test period and connecting the Procountor integration was easy. The data migration to Finadeck has been effortless for Vauraude as the integration automatically updates the data to Finadeck every night and manual updates are also possible. During the test period, Vauraus was also able to verify that Finadeck's user interface was modern and relatively easy to use, despite its rich functionality.

Automation leaves more time for human labour-intensive tasks

During the implementation, the internal transfer elimination rules and management reports for Finadeck were finalised for Vauraude. Some of the internal transactions were not historically in their own accounts, which is why an elimination company was set up in Finadeck, through which these transactions were eliminated from the group. In addition, a regulatory minimum capital requirement calculation report was built into Finadeck, and automatic transmission of the required reports to management and the Board of Directors was switched on.

In the photo, from left to right, Saku Pöllänen, CEO of Finadeck and Marjaana Ervasti, Chief Administrative Officer of Vauraus Suomi Oyj.

In addition to building the reports, Finadeck built a budgeting and forecast update guide for Vauraud based on the needs discussed with Vauraud during the implementation training, which will support the preparation of budgets and forecast updates in the future.

Following the transfer to Finadeck, Vauraus now prepares the budgets and forecasts of the special purpose vehicles in Finadeck and combines the profit and loss budgets, balance sheets and forecasts of the special purpose vehicles into budgets and forecasts for the group.

"We get an A for implementation and customer service"

"We give the implementation and customer service an A rating. All in all, Finadeck covers our group's reporting, budgeting, forecasting and accounting needs in a commendable way," Ervasti concludes. Finadeck has also taken into account the needs that have arisen along the way and has been able to react and build solutions in a reasonable timeframe to meet Vauraude's needs.

In the future, Vauraus will use Finadeck more extensively in reporting, budget scenarios and forecasts, as well as in the preparation of the consolidated financial statements and the consolidated financial statements.