Principles of group reporting

Group reporting is often perceived as complex, and therefore, especially in smaller groups, the Group's figures are often monitored only on an annual basis. However, group reporting has become increasingly agile to implement with most software offering interfaces for data transfer. Through the interfaces, the data can be transferred agilely from the companies' financial management software to the same database, from which the data of all companies can be conveniently utilised in reporting.

Therefore, work related to group reporting can be seen to consist of eliminations of intra-profit transfers, possible eliminations of balance sheets and attention to exchange rate differences.

Elimination of intra-result transfers

Elimination of intra-profit transfers refers to the removal of sales and expenses between the group companies from the Group's figures, so that, for example, the figure presented as a group sale only represents the sale to external companies. The degree of difficulty in eliminating intra-profit transfers of group companies can be seen to be determined at three levels, depending on whether the group's companies have the same chart of accounts or not, and depending on whether the group's companies use different currencies.

| Affiliates | Easy | Moderate | Challenging |

|---|---|---|---|

| Same chart of accounts | Yes | No | Yes |

| Same ledger accounts for internal transfers | Yes | Yes/No | Yes |

| Exchange rate differences | No | No | Yes |

In the easiest case scenario, the companies belonging to the group have the same chart of accounts, internal transfers are recorded in the same accounting accounts in all companies and exchange rate differences do not need to be taken into account. In this case, it is very simple to eliminate intra-profit transfers, as it is sufficient to sum the figures of the companies in the group without the accounts used for internal transfers.

If the companies belonging to the Group have different charts of accounts in use, the combination of the Group's profit figures will be slightly more of a challenge. The reason for the divergent charts of accounts may be, for example, that some companies operate abroad or that some companies operate in a completely different sector, for example. Therefore, when eliminating intra-group transfers, you must set company-specific rules which accounts you want to include for each company in the intercompany figures and under which group of intercompany accounts you want to sum those accounts.

In the most challenging situation, some of the companies belonging to the Group also operate in different currencies, which means that the elimination of intra-company transfers and the combination of figures must take into account not only the group's main currency but also exchange rate differences in the translation of the currency.

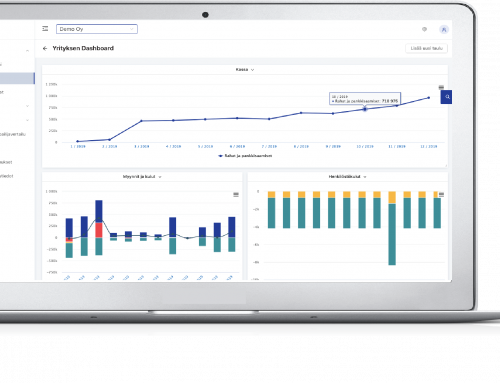

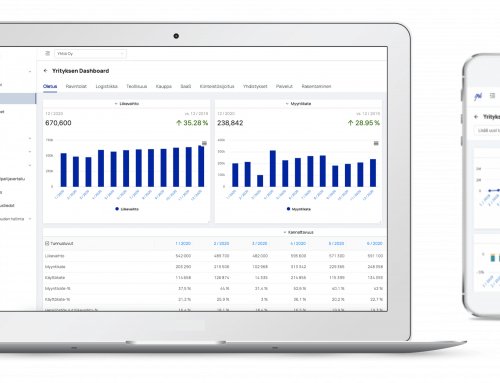

However, software specialising in group reporting, such as Finadeck, has comprehensive tools for building these rules, which makes it easy to combine and eliminate. As a result, group figures, especially regarding the Group's results, can be reported to management and the Board of Directors on a weekly and monthly basis automatically on a weekly and monthly basis, especially regarding the Group's results, without any additional hassle.

Eliminations of the balance sheet in intercompany reporting

As in assessing the degree of difficulty of eliminating a result, it is also a good idea to take into account the same things when assessing the degree of difficulty of eliminating a balance sheet, i.e. whether or not the companies belonging to the group have the same chart of accounts and whether the companies use different currencies. In addition, the elimination of intra-company holdings, the valuation of inventories transferred in internal transfers, and the elimination of internal margins add to the additional challenge of depreciations in the balance sheet.

The balance sheet of the financial statements of individual group companies shows the financial position and intra-group assets and liabilities of each of the companies in the group. In group reporting, the figures of the group companies are to be reported as if it were a single company, which is why, when the balance sheet is eliminated, the first step can be to consider the elimination of internal assets and liabilities.

Unlike eliminations of intra-profit transfers, which can be achieved by pre-mentioned rules, a separate elimination environment is often set up for reporting for imbalances in the balance sheet, in which the eliminations of the balance sheet can be entered. When the figures for the elimination environment are also taken into account in the calculation of the Group's figures, the elimination of the internal ownership of acquired companies can also be implemented agilely, for example.

Finadeck

In Finadeck's group environment, you can combine the actuals and budget figures of finadeck-activated subsidiaries, make the necessary eliminations of internal transfers and build group sheet reports easier than ever before.

In addition, it is possible to set up its own environment in Finadeck for the elimination company in relation to the balance sheet projects. In this way, the eliminations of the balance sheet exported to the elimination company, for example through Google Sheets, can also be taken into account in the group environment.

One click and you have all the tools you need to move your business forward.