Budgeting Guide

Five-step model for compiling a comprehensive cash forecast

This budgeting guide explains which five subbudgets a company should build to form a comprehensive, clear and easily adjustable cash forecast. The purpose of the guide is also to clarify the idea of what the budget consists of, how it is built and how to manage it.

Twoice hockey teams are aiming for the Olympic Games in three years' time. One of the teams decides not to prepare and invites the players directly to the games. One of the teams decides to start preparing right away by inviting the key players to the team right away. In addition, this team decides to recycle players in quarterly training game camps to get the best feel for a team that plays well together, measure player development, and engage players together.

Which team do you find it easier to adjust their training when they find that something isn't working as expected? Which team will find it easier to learn from mistakes made? Which team do you think will be more motivated during the three-year trainingseason? Which team could we learn more about profitable business from?

Sub-budgets

The team's training programme and the target results of the tests at the end of the training programme for different areas are comparable to the company's sub-budgets. Comparing results with sub-budgets at regular intervals helps to understand what is achievable and what the realities are.

The most common way to create sub-budgets is to divide them into sales, variable costs, marketing costs, fixed costs, and investments. A cash forecast can be compiled from the sub-budget package that enables the company and its stakeholders to review the development of the company's cash register. If you wish, you can read the article on the cash flow and financing statement later.

So let's start with the sub-budgets.

-

Sales budget

Even in this budgeting guide, there is no one right way to make a sales budget, as the factors affecting the sales budget are industry-specific and company-specific.

For example, a workshop that manufactures hydraulic cylinders can make its sales forecast mainly based on customer purchase estimates, the reality of the previous financial year and the projected growth. The software company, on the other hand, can generate its sales budget based on historical sales figures and verified growth.

Despite the fact that there is no one and the right way to make a sales budget, making a realistic sales budget is one of the most important steps in budgeting. The reason for this is that other sub-budgets are often closely linked to the sales budget and without a realistic sales budget, the company easily enters a cash crisis as expenditure increases above revenue.

In addition, a realistic sales budget can be utilised as part of setting targets and rewarding the company's personnel.

-

Variable cost budget

In budgeting, variable costs refer mainly to the costs related to the service or product sold, as well as variable wage costs. As stated above, the budget for most frequently variable costs is based on the sales budget.

In manufacturing and manufacturing companies, variable costs include materials, supplies and energy needed to manufacture products, the consumption of which is often directly related to the consumption of products sold. The variable costs of wages include the amount that is fully linked to the production volume, such as contract wages.

In retail companies, variable costs often include the purchase costs of products sold, including shipping costs. In the retail sector, the variable costs of wages often include the commission share of sellers' salaries, where they are directly dependent on the volume of sales.

Of course, companies that provide services often account for a smaller proportion of sales than companies in the industry or trade. In companies providing services, the variable costs include the direct costs of providing the service, which would not be incurred if the service were not produced at all. For example, transport companies' variable costs include tyre and maintenance costs and fuel costs incurred directly in relation to the mileage driven.

(Budgeting in Finadeck)

-

Marketing budget

Marketing costs refer explicitly to all marketing costs. Due to seasonal variations and cash forecasting, marketing costs are smart to distribute to the monthly level, as marketing investments also vary from season to season.

-

Fixed cost budget

Fixed costs refer to costs that do not depend on the products or services sold by the company. These include rent, fixed wages and related personnel costs and accruals.

When budgeting wages, it is also a good idea to pay attention to the costs of persons and the accrual of holiday pay debts and holiday return allowance, so that the payments of holiday pay debts and holiday return allowances in particular do not surprise you.

For example, it is assumed that the company pays salespeople a salary of EUR 3000 per month, according to the employment contract. In our example, it is assumed that no employee is a shareholder, so the personnel costs paid to the company will be paid as follows:

- average earnings-related pension insurance 17.35%,

- health insurance contribution 0,77 %,

- unemployment insurance contribution 1,50 %,

- accident insurance contribution 0.80% and

- group life insurance 0,07 %

i.e. approximately 19.77% in total. Therefore, in this example, personal page costs should be budgeted for approximately 20 per cent of estimates, i.e. 600 € / month per person. Holidays for each employee accumulate 2.5 days per month. In this example, the holiday pay debt reserve must be made from wages and personnel by-side expenses, i.e. the amount of the holiday pay debt reserve would be 360 € / month / employee ((3000 + 600) / 25 working days * 2.5). In addition to holiday pay , employees are often also paid a holiday return allowance of 50% of the holiday pay accrued , i.e. in this example it is good to prepare for holiday return pay of EUR 150 per month (3000 / 25 working days * 2.5 * 50 %) . Therefore, it is a good idea for the company to budget the wage costs at €4,100/month/person (€3,000 salary + €600 per person-side costs + €360 holiday pay debt reserve + €150 holiday return allowance).

When a company's holiday pay debt provisions and other accruals are made not only in the budget, but also in the accounts on a monthly basis, the company can reliably monitor how the company's cash flow develops according to the implementation relative to the budget. The timeliness of the data is useful in monitoring, decision-making and dodging the biggest pitfalls.

-

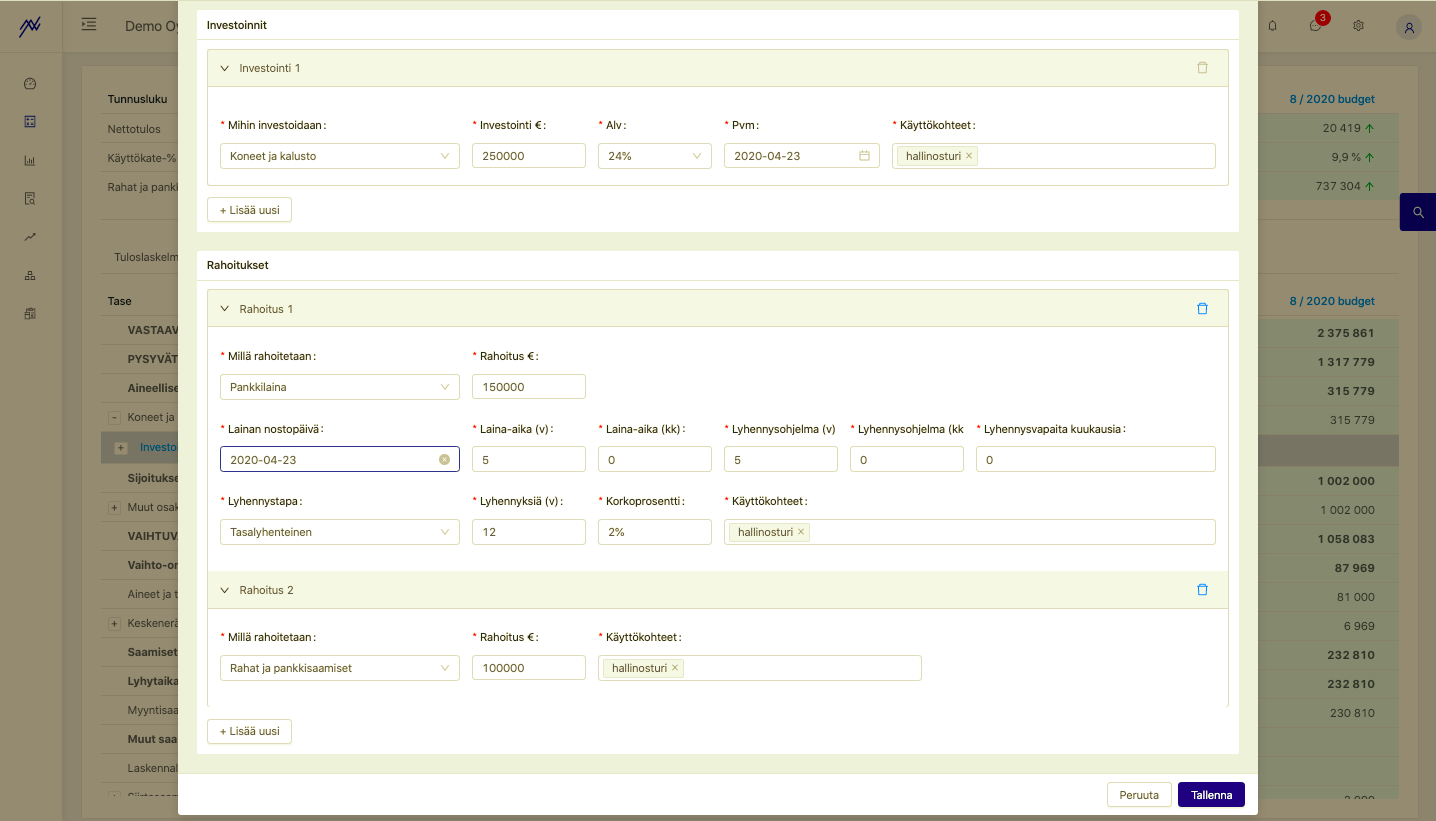

Investment budget

Investments refer to acquisitions of intangible or tangible assets that are expected to generate income for the enterprise, usually for more than 12 months.

For example, Konepaja Oy can calculate that it will invest €250,000 in a new crane, of which it plans to finance €150,000 with a bank loan and the rest of €100,000 from its own fund. Software Ltd could calculate that it will invest EUR 10,000 directly in new computers and finance the investment directly from the cash register.

(Investment planning in Finadeck)

Before the investment is carried out, it makes sense to check that the company's cashier will be able to withstand the self-financing rate and any repayment of the loan. This is possible when a company has a realistic budget for sales, variable costs, marketing and fixed costs.

Unlike other pre-mentioned sub-budgets, general statements of investments are made in the accounts instead of in the income statement on the balance sheet from which the cost of assets included in permanent assets (taxable assets) is eliminated through profit or loss during its useful life from the income that the asset's benefits are from. The logic of profit and loss and balance sheet was opened in more detail in the "Logic of profit and loss and balance sheet in vernago" article.

Budget scenarios

If something negatively surprising comes up, especially when making larger investments, the company may be plunged into a cash crisis. That's why we recommend building an alternative plan in advance in our budgeting guide. If something positively surprising were to come up, it is also useful to prepare for it in advance. With regard to the main budget for the sub-budget, it makes sense not only to have a neutral scenario, but also to make best and worst case scenarios. They help prepare for unexpected situations.

Predictions

Like any team, a company needs to learn from its mistakes and optimize its operations in order to succeed. Let us imagine that, after the first three months, it seems that the annual budget will be exceeded or undersed. The forecasts allow the remaining period to be updated to reflect the status quo and the necessary measures to be planned in good time. By creating shorter-term forecasts alongside the annual budget, the company can therefore monitor the development of the financial situation more closely and react more quickly. However, it is advisable to maintain the annual budget as it stands in order to assess the achievement of the larger milestones.

How

Top-down and bottom-up budget

Budgeting is usually managed in companies either from top to bottom or from the bottom up. In the former, the management of the company sets financial targets, operational targets and a set of indicators to be provided to the carrying party. The latter, more inclusive model, is moving in a different direction. If each salesperson in the company were allowed to budget their own sales for the upcoming period, the budget would be bottom-up. In order to encourage sellers, the company could create a cost center for each one in the accounts, from which the seller could easily review the implementation of their budget and update their forecasts as needed. If necessary, it is a good idea to distribute the budget to different cost center, dimensions, projects, etc.

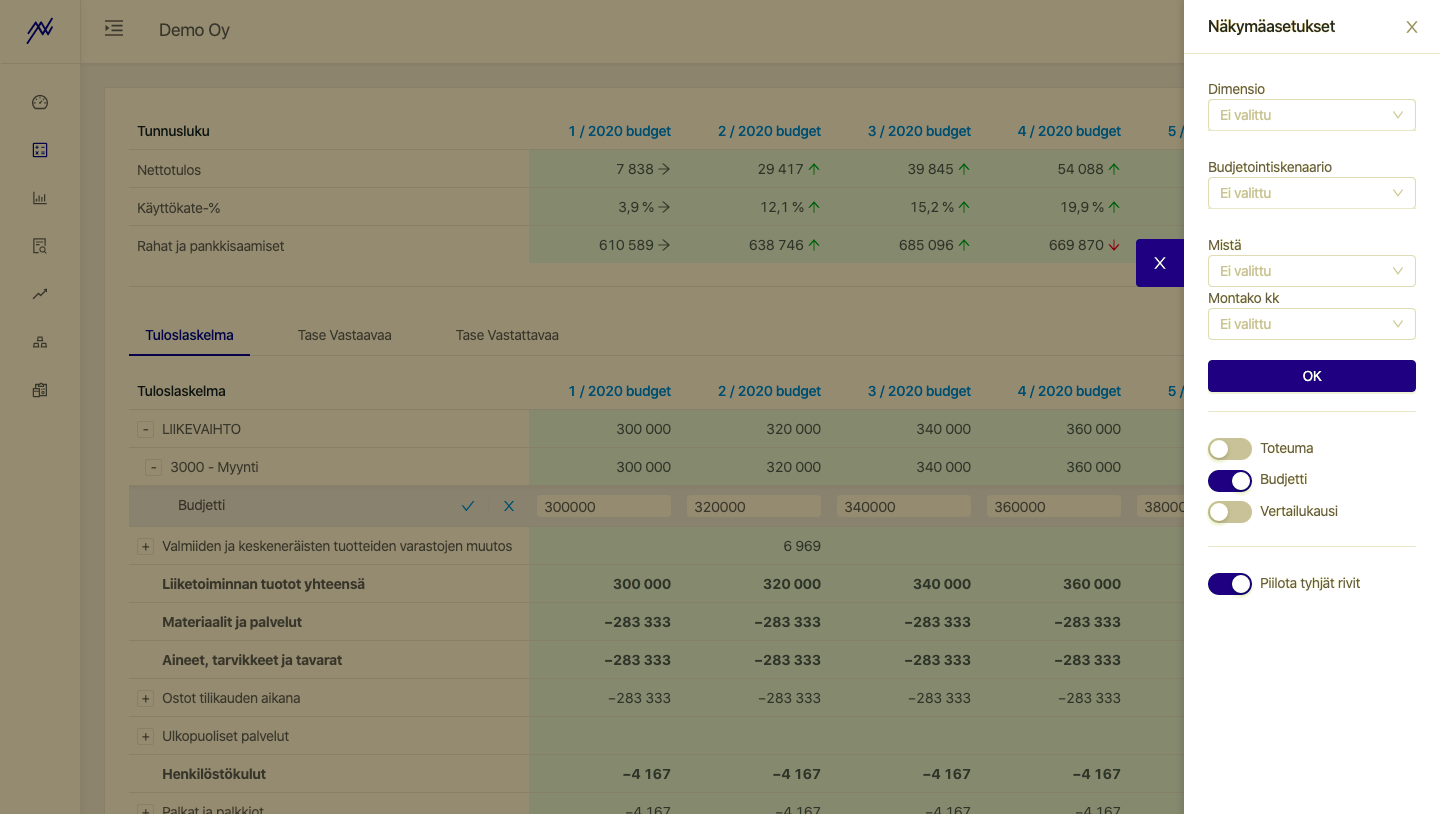

Monitoring and comparing the implementation with the budget and forecasts

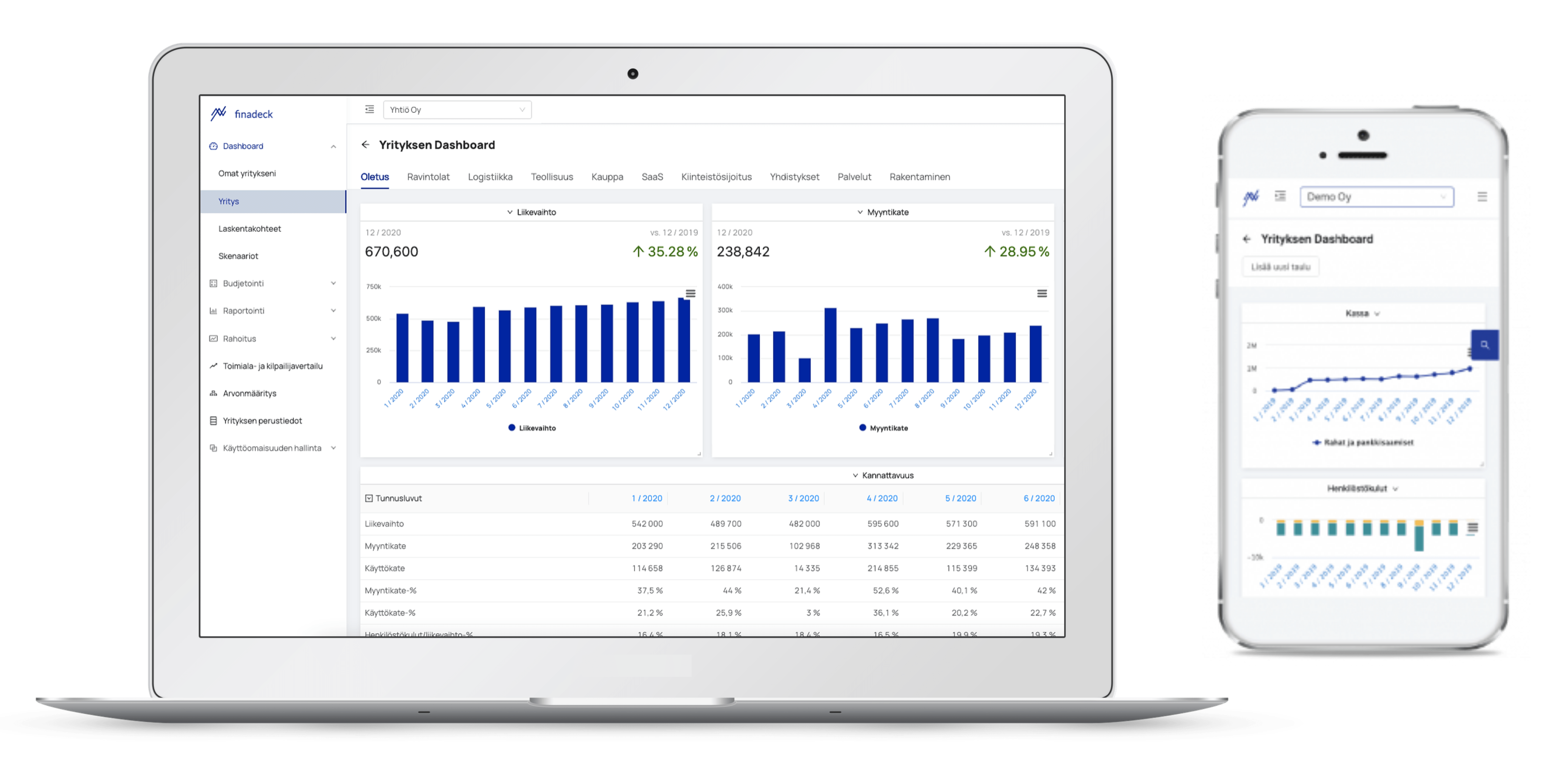

Comparing the profit and loss account and balance sheet with handmade budgets quickly gets laborious and frustrating. The most popular option is the latest financial management and reporting software, where the system is updated automatically. Efforts have been made to make monitoring the outcome so effortless that anyone with access to it can do so. The budget and its differences can be read quickly from succinct visual graphs and graphs.

(Monitoring the financial situation from a customizable dashboard in Finadeck)

Some financial management and reporting software also offers companies the opportunity to tailor a user interface that suits their needs. For example, management can monitor at a glance the sales and margins of each seller, as well as key indicators that are most important to the company's business, such as the development of the cash situation, the EBITDA and financial results percentage, and the equity ratio.

Finadeck's intelligent financial management and reporting software is designed to make it easier for companies in budgeting, investment planning, analysis of key figures and cash flow, and – visual reporting, industry and competitor comparison, valuation and financial search.

More information on annual leave:

https://www.tyosuojelu.fi/tyosuhde/vuosiloma

For more information on person page charges:

https://www.yrittajat.fi/yrittajan-abc/tyonantajan-abc/tyonantajamaksut/tarkeita-lukuja-2019-599967

More information on tax depreciation rates for investments in the business sector: