Logic of the profit and loss account and balance sheet in vernacular

Understanding the logic of the income statement and balance sheet is important for the entrepreneur, as all the company's cash flows move within them in the accounts. The accounts may include both profit and loss and balance sheet entrories or only intra-balance sheet transfers. After internalised the profit and loss account and the balance sheet, the entrepreneur can form a more comprehensive picture of the finances of his or her own company or other companies. It is justified to suggest that the factual management of the company is created by the factual management of the company.

The logic of the income statement

TThe purpose of the calculation is to help the reader understand where the income and expenses of the enterprise for a given period of time came from. According to the most common accrual-based accounting method, for example, future revenue from sales invoices is marked on the corresponding side of the balance sheet on its own line as receivables. On the other hand, future expenditure on purchase invoices is marked as accounts payable on the side of the balance sheet until the invoice is paid from the cashier.

Mirrored on the personal side, it can be thought that the income statement describes everyday income and expenses. The wages received by the person can be assimilated to turnover and current expenses, such as electricity bills, rents and insurance premiums for business expenses. It is good to note that rent paid for a rental apartment would be included in everyday (business) expenses, while the entries for the repayment of a loan paid for owner-occupied dwellings are only recorded in the balance sheet.

The reason for the balance sheet-based postings of fixed assets for repayments is that their expenses are recognised in the result according to the depreciation plan based on the estimated useful life of the fixed asset. Consequently, the recording of repayments on a performance basis would result in a double entry for the items to be removed. The purpose of the anuffles is therefore to deduct the cost of assets included in permanent assets (fixed assets for tax purposes) during their period of impact from the income that the asset's benefits are in.

Balance sheet logic

The word balance sheet is the Finnish equivalent of the previously commonly used word "bilanssi". Bilanssi, like many other accounting terms (debit, credit, balance, etc.), has entered the Finnish accounting language from the home country of accounting, Italy, where the term bilanssi appears as the term "bilancio". Bilancio is derived from the original Latin word "bilanx", where "bi-" describes a double and "lanx" a scales (in its full form, libra bilanx). So, "bilanx" refers to a scale with two scales. That is exactly what the balance sheet is: a double-sided balance (assets-liabilities), in which the financial quantities of an enterprise are compared with each other at a certain point in time.

Mirrored on the private side, it can be thought that the corresponding (what is owned) side is marked as owner-occupied housing, a car owned by a person, holiday pay already already married and the eur 1,000 in the person's bank account. The liabilities (which are used to own) would be marked on the side of the surplus (profit), housing and car loan and outstanding invoices, cumulatively accrued over time, the difference between wages and expenses.

Similar

The main purpose of the corresponding side of the balance sheet is to illustrate what is owned and what and what kind of receivables the enterprise has at a given time. On the corresponding side of the balance sheet, assets are divided into permanent assets that generate returns of more than one year, as well as assets and receivables that generate income during less than one year.

The corresponding items on the side are therefore grouped in reverse liquid order. At the top, the most difficult-to-cash assets are presented, and the most easily convertible item of money and bank assets is last. Other items on the assets side are various intangible and tangible assets, equipment, investments, inventories, receivables, financial securities.

Liabilities

The main purpose of the liabilities side of the balance sheet is to help the reader understand how the assets on the assets side of the balance sheet have been financed. On the liabilities side of the balance sheet, the sources of financing are divided into equity, accruals of financial statements, assets and liabilities. In practice, therefore, the liabilities side of the balance sheet shows whether the holdings and receivables are financed by equity, such as assets invested in the company or retained income from the business or with liabilities.

On the liabilities side, the liabilities are divided into long-term and short-term liabilities. Long-term liabilities in more than one year' s time, such as repayments of a loan over one year later and liabilities to be paid into short-term liabilities, such as repayments of the loan within one year of the reference period, are entered in the short-term liabilities. Therefore, as we delve deeper into debt, the liabilities side will also find out which part of the liabilities, such as bank loans, purchase liabilities and taxes, is planned to be paid within one year of the present date and which part after more than one year.

The accrual of financial transfers between equity and debt is recognised as unrealisation but already recognised as expenses and deducted for tax purposes. Mandatory provisions, such as pension liabilities, are of a debt nature. The difference between mandatory reservations and liabilities is that the amount of the provision or the date of actualation has had to be assessed.

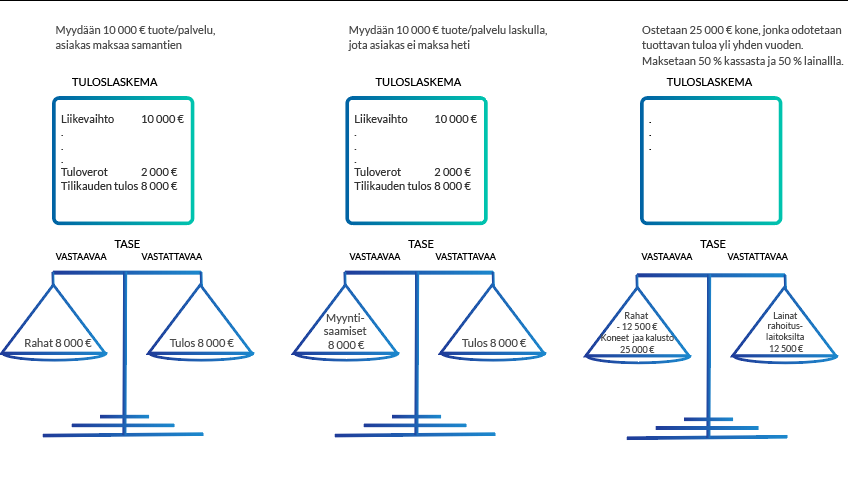

Logic of the profit and loss account and balance sheet simplified without taking into account VAT

Summary

As stated, the profit and loss account and balance sheet include all the cash flows of the enterprise. It can therefore be difficult to understand the financial situation, cash flow and future forecast simply by looking at their batches. It is therefore advisable to lead key figures analyses and reports from the income statement and balance sheet to help assess the company's profitability, liquidity, solvency and working capital. The cash flow statement, on the other hand, makes it easier to monitor the company's cash flows and to understand the cash situation of the future.

Finadeck's intelligent financial management and reporting software is designed to make it easier for companies in budgeting, investment planning, analysis of key figures and cash flow, and – visual reporting, industry and competitor comparison, valuation and financial search.